bank owned life insurance tax treatment

The new section limits the amount of tax-free treatment a person which can be any type of entity can receive from the proceeds on an. Taxpayer maintains a BOLI Program in which it acquires life insurance policies from a variety of life insurance providers on a group of its officer-level employees.

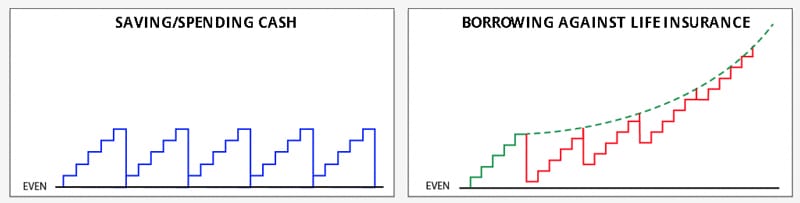

Life Insurance Loans A Risky Way To Bank On Yourself

The tax treatment of corporate-owned life insurance COL I continues to receive scrutiny from congressional tax writers and the Obama Administration.

. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. As shown in Figure 1 most community bank BOLI assets are considered simpler general account assets which are unsecured obligations of the insurance company. In addition most BOLI policies are classified as Modified Endowment Contracts.

The bank purchases and owns an insurance policy on an executives life and is the beneficiary. What are the tax consequences of surrendering Bank Owned Life Insurance BOLI. Please note the results described as to taxation deductibility of premiums and effect of death benefits and cash value changes can vary from the accounting treatment per ASC 7840 formerly FAS 109.

Upon the executives death tax-free death benefits are paid. National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh. However if the BOLI policy is transferred for value ie the purchase of an existing policy r.

Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options. Banks can purchase BOLI policies in connection with employee compensation and benefit plans key person insurance insurance to recover the cost of providing pre- and post-retirement employee benefits insurance on borrowers and. Citizens or resident aliens for the entire tax year for which theyre inquiring.

Tax treatment is changed existing plans may be grandfathered. However an IRS rule codified in IRC Sec. Bank-owned life insurance is a type of life insurance bought by banks as a tax shelter leveraging tax-free savings provisions to fund employee benefits.

This of course is done within the context of a legitimate business reason. 101 j subjects employer owned life insurance benefits to taxation unless they qualify for an exception and Notice and Consent requirements are satisfied. The taxation of this BOLI transaction is governed by Internal Revenue Code Section 72.

101 j 1 was added with the enactment of the Pension Protection Act of 2006 PL. However The Pension Protection Act of 2006 enacted important statutory changes to the general rule for employer-owned life insurance contracts stating that death benefits received. IRS Taxation of Employer Owned Life Insurance.

If you are receiving the proceeds in installments whether there is a refund or period-certain guarantee If federal income tax was withheld from the life insurance proceeds The tool is designed for taxpayers who were US. Life insurance on key employees and owners can be a powerful tool. Any gain above the premium that the bank paid would be taxed at the normal rate.

Financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy. Also some BOLI is considered to be a Modified Endowment Contract MEC for tax purposes and early redemption can trigger an additional 10 excise tax. Cash surrender values grow tax-deferred providing the bank with monthly bookable income.

This general rule changed when Sec. While any insurance owned by a bank can be referred to as BOLI the term is most often applied to insurance marketing programs in which life insurance is offered to a bank specifically as an opportunity for the bank to take advantage of tax deferred cash value growth. It can generate tax-exempt proceeds that companies can use to help protect themselves against the death of key personnel while providing critical liquidity to the company if it must buy back shares from a deceased owners estate.

The separate accounts including varioussub-accounts typically consist of. You Took Out a Policy Loan and the Life Insurance Ends If you. The type of BOLI held generally varies by the size of the bank.

IRC 101 j applies to employer. The BOLI Policies are invested in the general accounts and separate accounts of the BOLI insurers. In general proceeds from life insurance policies are tax free under the general exception rules in Sec.

The sweeping Tax Cuts and Jobs Act TCJA signed into law in late 2017 includes a provision that appears to apply to bank-owned life insurance BOLI which often is used as a tax-free investment for banks sometimes but not. However if they may be surrendered for their cash surrender values. In general life insurance benefits received upon the death of an insured are tax-free.

Bank Owned Life Insurance BOLI Bank Owned Life Insurance BOLI is defined as a company owned insurance policy on one or more of its key employees. In the past money received through a life insurance contract paid by reason of the death of the insured were generally not includable in gross income for federal tax purposes. Transactions structured or otherwise treated as purchase of assets and assumption of liabilities PA.

Youll be taxed on the amount you received minus the policy basis. This taxable amount reflects the investment gains that you took out. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs.

The general rule for bank-owned life insurance BOLI is that proceeds received by reason of death are tax free. However at larger community banks as a whole the balances of BOLI assets in separate accounts or hybrid accounts grow. While progress toward reform of the Internal Revenue Code IRC may slow in light of the upcoming congressional midterm elections a proposal that.

Cash Flow Banking With Whole Life Insurance Explained

Tax Deductible Life Insurance Business Owners

Understanding Life Insurance Policy Ownership The American College Of Trust And Estate Counsel

Key Man Life Insurance What Is It How Does It Work 2022

Tax Deductible Life Insurance Business Owners

Are Life Insurance Premiums Tax Deductible In Canada

Life Insurance Policy Loans Tax Rules And Risks

Bank Owned Life Insurance Boli

Life Insurance As A Tax Planning Tool Insights People S United Bank

Life Insurance Policy Loans Tax Rules And Risks

Corporate Owned Life Insurance Everything You Must Know

Life Insurance Loans A Risky Way To Bank On Yourself

Is Life Insurance Taxable Forbes Advisor

Do Beneficiaries Pay Taxes On Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Common Mistakes In Life Insurance Arrangements

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

The Ins And Outs Of Life Insurance Policy Ownership Coastal Wealth Management