voluntary life and ad&d worth it

What Is Voluntary Life and ADD Insurance. Updated Mar 31 2021.

What Is Ad D Insurance Youtube

Accidental death and dismemberment insurance ADD for example is a benefit many companies offer but few people understand.

. Voluntary life and ADD from work. As leading cause of death 30-40s is trauma I thought it might be worthwhile for younger folks on top of the base normal term life as it comes at a discount. Term and Whole Life Insurance.

Accidental death dismemberment ADD insurance is a type of insurance commonly added as a rider to a persons health insurance or life insurance. Essentially would pay if you died in an accident but not of natural causes. VoluntarySupplemental AD D offered as employee-paid coverage can be tied to supplemental life insurance coverage or as a separate stand-alone election.

Ad Life Insurance For Ages 18 to 85. If the death is from natural causes your policy simply pays out the base amount. Voluntary life insurance and accidental death and dismemberment ADD policies are offered to employees as part of a companys benefits plan and you can typically purchase coverage for yourself your spouse or your children.

I would recommend getting the ADD as well as looking into a small whole life policy 10-20K because right now is the cheapest it is going to be. It only covers accidents not natural death or injury from illness. The employee pays the monthly premium to the insurance company offering the policy.

Accidental death and other covered losses occur rarely so ADD costs much less than term life coverage with similar limits. Voluntary life insurance is a form of group life insurance in which an employer takes out a supplemental life insurance policy on behalf of their employees to provide them with additional coverage. The cost of ADD insurance is lower than that for traditional life insurance because the coverage is limited to accidents only.

With term life insurance the employee is covered for a specific term 1 5 10 or 20 years at which time the employee can either cancel or renew the policy. The biggest difference between term life and ADD insurance is that an ADD policy pays out only for a death or dismemberment caused by an accident while a term life policy pays out regardless of the cause of death with some exceptions. Voluntary Life and ADD Insurance.

Basic AD D is employer-paid coverage which provides an accidental death benefit often equal to an employees basic term life insurance amount. It was an optional addition to the term insurance Accidental Death and Dismemberment. Is Voluntary life ADD worth it.

There are several options for purchasing both ADD coverage and life insurance. I believe as long as its below 50k it is not included as taxable income for the employee. Voluntary Accidental Death And Dismemberment Insurance - VADD.

If you want both life insurance and ADD insurance a rider is a viable option. For example monthly premiums might start at 450 for every 100000 in accidental death coverage from Farmers. Reviews Trusted by 45000000.

In general ADD insurance premiums are tied to the amount of coverage you purchase. For example Jordan is married with children and has a. ADD holds particular appeal for young workers who statistically are more likely to die from accident than illness.

Is ADD insurance worth it. Voluntary accidental death and dismemberment insurance VADD is an additional protection plan. You can purchase ADD insurance as a separate product or endorsement on your life insurance policy.

This makes it an attractive benefit for your employees even if offered on a voluntary basis. Some participants choose voluntary term life as a supplement to their whole life insurance. But you likely dont need to buy your own individual ADD policy especially if you have term life insurance and disability insurance.

Dependent AD D insurance is an employee-paid. People with riskier jobs pay higher premiums than people with low-risk employment. You may only apply for.

Lets say a person purchases an ADD policy worth 100000 is in an accident. Get an Instant Free Quote Online. Voluntary life insurance is a financial security and protection policy that at the time of the death of the insured policyholder pays a recipient or beneficiary with a cash payment.

ADD insurance premiums are as low as 60 per year depending on the amount of coverage you buy and the benefits it provides. If you can get group coverage for accidental death and dismemberment then its worth having especially if theres no cost to you for the premium. Ad Compare the Best Life Insurance Providers.

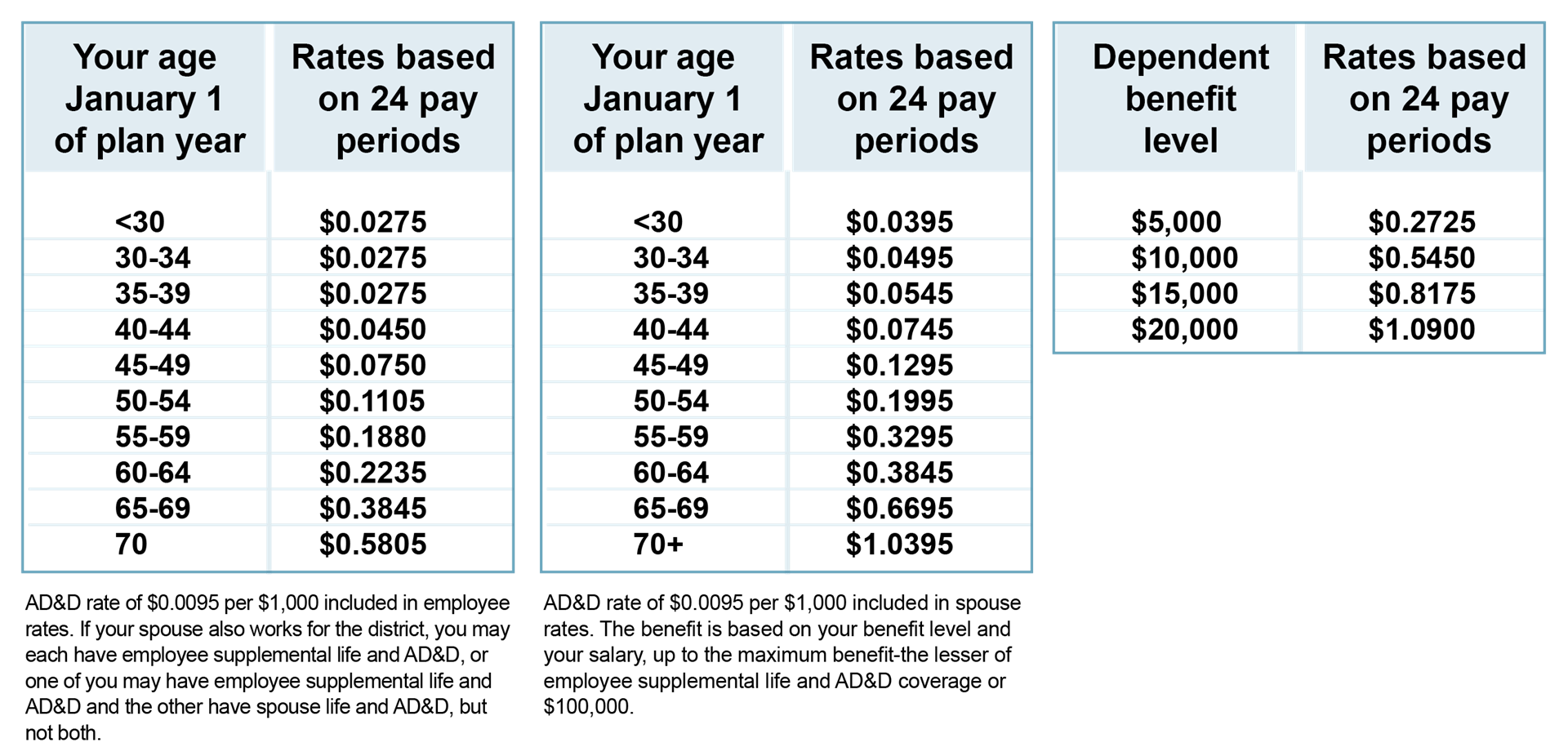

The premiums for voluntary term life are based on your age. The premiums are tied to the amount of basic voluntary life insurance you purchase. Voluntary term life insurance is the most common type of voluntary life insurance offered to employees.

No Visits to the Doctor. You will have a guaranteed low rate for the rest of your life probably around 20month instead of getting a policy later when you are older might have picked up some bad habits or have been diagnosed with an illness. What is the difference between voluntary life and voluntary ADD.

Ad Our Comparison Chart Did the Work. Supplemental ADD coverage could be a wise investment regardless but understand that ADD doesnt cover you for any type of death or dismemberment. Voluntary life insurance is an employee benefit option offered by many employers to their employees.

Employee benefits especially insurance can be complicated. Term and Whole Life Insurance You Can Rely On. If youre young and unable to qualify for good rates from an insurer.

ADD insurance is not a replacement for life insurance. Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death. The voluntary life insurance would be additional insurance on top of this which you can purchase.

Is Voluntary life ADD worth it. ADD is generally less expensive or in some cases an extra benefit to the current life insurance policy. Ask an expert about life insurance companies that offer an ADD rider.

An ADD rider also known as a double-indemnity rider pays out an extra amount if your death is accidental. A financial protection plan that provides a beneficiary with cash in the event that the policyholder is accidentally killed or loses. Just Click the Best Policy Buy Life Insurance Easily.

With ADD insurance any beneficiaries listed on your policy will receive the lump-sum payment. Voluntary ADD could be worth it for those who want some measure of life insurance coverage but cannot afford a voluntary term life insurance policy. Rates will vary from insurer to insurer and can start as low as 450 per month for 100000 of coverage.

Typically the group life is for included as a fringe benefit at no cost to the employee and is tax deductible by the employer. An ADD policy may be a good idea especially if you work in a high-risk job.

Group Voluntary Term Life Insurance Ppt Download

Life Insurance Vs Ad D Differences Explained The Motley Fool

How Does Voluntary Life And Ad D Insurance Work Cake Blog

Ad D Vs Life Insurance Differences How To Pick

What Is Voluntary Life And Ad D Insurance Sensational Things About Life Insurance Let Us Talk Finance

Accidental Death And Dismemberment Insurance What You Need To Know

What Is Voluntary Life Insurance How Does It Work In 2022

Life Ad D Voluntary Life Insurance Bcsg Insurance Services Llc

What Is Voluntary Life Insurance And How Does It Work

What Is Voluntary Life And Ad D Insurance Sensational Things About Life Insurance Let Us Talk Finance

Group Voluntary Term Life Insurance Ppt Download

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

Ad D Vs Life Insurance Differences How To Pick

Voluntary Benefits Life And Ad D

What Is Voluntary Life Insurance How Does It Work In 2022